![]() Multi Disciplinary research bulletin: Volume 02, Issue 01 |

Multi Disciplinary research bulletin: Volume 02, Issue 01 |

February 2023 | ISSN 2583-5122 (online)

Trend Analysis of Millets in India

Abstract

The crop with the highest nutritional value and the most health advantages is millet. In many parts of the world, specifically in Africa and Asia, millet is a popular grain. It is a staple food in many parts of the world, especially in Africa and Asia. According to the World Food Programme, millet is consumed by 1.2 billion people worldwide. India is both the world’s largest producer and exporter of cereal products. The main states in India that grow millet are Rajasthan, Maharashtra, Karnataka, Andhra Pradesh, and Madhya Pradesh. A large number of farmers in these states grow millet primarily for the domestic and international markets. In recent years, millet production has remained largely stable, with an anticipated 28 million metric tons of millet production in 2020. The majority of millet is produced in Africa, followed by Asia. India is the largest producer of millet, followed by Niger and China. Other major millet-producing countries include Burkina Faso, Mali, and Senegal. While millet is not a major food crop in the developed world, it plays a vital role in the diets of many people in developing countries. Millet is a drought-tolerant crop that can be grown in dry, arid climates where other crops would fail. It is also a nutritious grain that is high in fiber and essential minerals. For these reasons, millet will continue to be an important food crop in the years to come. As part of its National Food Security Mission, the Indian government has also encouraged the cultivation of millet. The production of millet in India is anticipated to increase over the following years as a result of the above factors.

Millets are among India’s top 5 exports. Millet exports increased from $400 million in 2020 to $470 million in 2021 (ITC trade map). India exported millets worth $64.28 million in 2021–22, up from $59.75 million in 2020–21. Millet-based value-added products have a very small share of the market. This study aims to study the trends of Millets over the past 10 year’s data.

Introduction:

Millets are a collective group of small-seeded annual grasses that are grown as grain crops, primarily on marginal land in dry areas of temperate, subtropical, and tropical regions. Millet has gained popularity over the past 10 years around the world, but it is actually an age-old nutri cereal in India that has been considered a staple food in many parts of rural India. Production of millet in India dates back to 3000 B.C., i.e., during the Indus Valley Civilization. It is believed to be the first crop cultivated for domestic purposes in India. Now, it is grown in 131 countries around the world, and the majority of the cultivation is carried out in Asia and Africa. Millets are cultivated in dry lands under a wide range of climatic conditions and marginal conditions of soil and moisture. Despite the fact that there has been a drastic reduction in cultivated areas of millets in India, India still stands as one of the world’s major producers of millets. The main states in India that grow millet are Rajasthan, Maharashtra, Karnataka, Andhra Pradesh, and Madhya Pradesh. A large number of farmers in these states grow millet primarily for the domestic and international markets.

There are three types of millets, i.e., major, minor, and pseudo millets. Major millets include Sorghum (Jowar), Pearl Millet (Bajra), Finger Millet (Ragi/Mandua), Minor Millets include i.e. Foxtail Millet (Kangani/Kakun), Proso Millet (Cheena), Kodo Millet (Kodo), Barnyard Millet (Sawa/Sanwa/ Jhangora), Little Millet (Kutki) and two Pseudo Millets (Buck-wheat (Kuttu) and Amaranthus (Chaulai).

The Government of India had proposed to the United Nations for declaring 2023 as International Year of Millets (IYOM). The proposal of India was supported by 72 countries and the United Nations General Assembly (UNGA) declared 2023 as the International Year of Millets on 5 th March, 2021. Millets are among India’s top 5 exports. Millet exports increased from $400 million in 2020 to $470 million in 2021 (ITC trade map). India exported millets worth $64.28 million in 2021–22, up from $59.75 million in 2020–21. Millet-based value-added products have a very small share of the market.

Keeping the above scenario in view, the present study aimed at analyzing the production, cultivated area and productivity of millets in past 10 years i.e. 2012-2022

Table No 1: Nutritional composition of staple cereals

|

S.No |

Name of the Cereal |

Protein (g) |

Carbohydrates (g) |

Fat (g) |

Crude fibre (g) |

Mineral matter (g) |

Calcium (mg) |

Phosphorus (mg) |

|

1 |

Sorghum (Jowar) |

10.4 |

72.6 |

1.9 |

1.6 |

1.6 |

25 |

222 |

|

2 |

Pearl millet (Bajra) |

11.6 |

67.5 |

5.0 |

1.2 |

2.3 |

42 |

296 |

|

3 |

Finger millet (Ragi) |

7.3 |

72.0 |

1.3 |

3.6 |

2.7 |

344 |

283 |

|

4 |

Foxtail millet |

12.3 |

60.9 |

4.3 |

8.0 |

3.3 |

31 |

290 |

|

5 |

Barley |

11.5 |

696 |

1.3 |

3.9 |

1.2 |

26 |

215 |

|

6 |

Maize |

11.5 |

66.2 |

3.6 |

2.7 |

1.5 |

20 |

348 |

|

7 |

Wheat |

11.8 |

71.2 |

1.5 |

1.2 |

1.5 |

41 |

306 |

|

8 |

Rice |

6.8 |

78.2 |

0.5 |

0.2 |

0.6 |

10 |

160 |

Source: NIN, Hyderabad

Materials and Methods

Nature and sources of data:

The study is conducted based on secondary data collected from different sources to fulfill the objectives. Secondary data was collected from various websites like APEDA, IIMR, Statista, IndiaStat and E-Articles in Business standard, Index box and a few other Millet Market Research agencies.

Analytical tools

For the purpose of evaluating the objectives of the study, based on the nature and extent of data availability, the following analytical tools will be used for analyzing the data to draw meaningful results and conclusions. Year wise cultivated area and production of Millets in India has been collected and analyzed by using standard statistical tools like arithmetic mean and coefficient of variation, compound growth rates and graphical representations to know the trends in area, production and productivity of Millets in India.

Compound annual growth rate analysis:

To study the annual growth rate in area and quantity of Millets, the compound growth rate was computed using semi-log or exponential model (Kulkarni et. al. 2012).

If yt denotes the observation (e.g. agricultural production, productivity, or area) at time t and r is the compound growth rate, model employed for estimating r is based on Eq. (1):

yt = y0 (1 + r) t …(1)

The usual practice is to assume a multiplicative error-term exp (ε) in Eq. (1) so that the model may be linearized by means of logarithmic transformation, giving Eq. (2):

In (yt ) = A + Bt + ε …(2)

where, A = ln (y0 ), and B = ln ( 1 + r ). Eq. (2) is then fitted to data using “method of least squares” and goodness of fit is assessed by the coefficient of determination R2. Finally, the compound growth rate is estimated by Eq. (3):

r^ = exp (B^ ) – 1

Coefficient of variation (CV)It explains the fluctuations over the period as follows:

The coefficient of variation (CV) is the ratio of the standard deviation to the mean and shows the extent of variability in relation to the mean of the population. The higher the CV, the greater the dispersion.

CV = Standard Deviation / Mean

Results and Discussion:

The findings of the study are presented as follows:

Trends in Area, Production & Yield of Nutri Cereals (Millets) in last 10 Years in India:

In India, Millets are cultivated mainly in Rajasthan, Uttar Pradesh,Karnataka& Andhra Pradesh. The overall statistics of Millet cultivated area, production and productivity shows a decline over past 10 years i.e. from 2012 to 2022.

Table No 02:Trends in Area, Production & Yield of Nutri Cereals (Millets) in last 10 Years in India

|

Year |

Area (‘000 Hectares) |

Production (‘000 Tonnes) |

Yield / Productivity (tonne per Ha)) |

|

2012-2013 |

15396.868 |

16033.51455 |

1.041349095 |

|

2013-2014 |

15480.051 |

17204.6961 |

1.111410815 |

|

2014-2015 |

15277.033 |

17076.29 |

1.117775291 |

|

2015-2016 |

14993.637 |

14517.38846 |

0.968236623 |

|

2016-2017 |

14718.132 |

16124.78627 |

1.09557288 |

|

2017-2018 |

14245.61 |

16436.45334 |

1.153790771 |

|

2018-2019 |

12542.5937 |

13710.92591 |

1.093149171 |

|

2019-2020 |

13829.243 |

17260.65146 |

1.248126991 |

|

2020-2021 |

13633.42 |

18020.55 |

1.321792331 |

|

2021-2022 |

9000 |

11700 |

1.31 |

Source: Secondary Data

Trend in Area and Production:

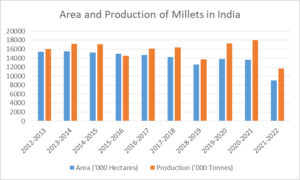

Fig 1: Trend in Area and Production

The above table shows that I 2020, there is highest record of Millet Production. In 2013, highest area recorded under Millet Cultivation.

Trend in Area and Productivity

Fig 2: Trend in Area and Productivity

The above chart indicates that the record of productivity is highest in 2020, as referred to Table No 2, production was also the highest in the year 2020.

Correlation between area and production:

Table No 3: Correlation between area and production

|

CORRELATION |

||

|

Area (‘000 Hectares) |

Production (‘000 Tonnes) |

|

|

Area (‘000 Hectares) |

1 |

|

|

Production (‘000 Tonnes) |

0.747557766 |

1 |

From the above table it can be inferred that there is a significant difference in area and production from 2012 to 2022 as the correlation coefficient value is 0.74. It can be understood that overall past 10 years Millet cultivated area and production has significantly increased.

Correlation between area and productivity

Table No 4: Correlation between area and productivity

|

CORRELATION |

||

|

Area (‘000 Hectares) |

Productivity (tonne per Ha)) |

|

|

Area (‘000 Hectares) |

1 |

|

|

Yield (tonne per Ha)) |

-0.64 |

1 |

From the above table it can be inferred that there is a significant negative difference in area and productivity from 2012 to 2022 as the correlation coefficient value is -0.64. It can be understood that overall past 10 years Millet productivity has significantly decreased.

Coefficient of variation (CV)

Table No 05: Coefficient of Variation

|

|

Area (‘000 Hectares) |

Yield (tonne per Ha)) |

|

Area (‘000 Hectares) |

3454548.703 |

|

|

Yield (tonne per Ha)) |

-121.9986023 |

0.011498261 |

From this table it can be inferred that there is significant negative difference between Area and Productivity as the Covariance value is negative that is -121.9986023.

Overall it can be stated that Millet Productivity has been decreasing over the period of time. Even though Govt. of India has initiated many schemes to increase the area and productivity of millets, the productivity remains decreased.

Compound Annual Growth Rate

The compound annual growth rate (CAGR) for area under Millet Cultivation is 2 percent which is significant at one percent probability level.The compound annual growth rate (CAGR) for production of millets over past 10 years i.e. from 2012 to 2022 is – 5 percent which is significant at one percent probability level. This shows that over the year, quantity of production of millets has reduced. The compound annual growth rate (CAGR) for cultivated area of millets over past 10 years i.e. from 2012 to 2022 is – 3 percent which is significant at one percent probability level. This shows that over the years cultivated area of millets has reduced.

Suggestions:

- As 2023 Year is declared as International Year of Millets by UNESCO, keeping this in view, Govt of India has already launched many schemes related to Millet Cultivation and Processing, which are to be taken to farmer level through Agricultural Extension Officers, Agricultural Assistants, NGOs, KVK’s and other Private entities. Only then the negative trends of area and production can be mitigated.

- Trend Analysis of Millets in India - February 20, 2023